Thursday Sept. 17 was another "mini" Boston Legal with just smokes and drinks imposed by the outside gathering constraints of COVID-19. Hosted at the Councilrock location, the days of Cincinnati gatherings may be limited as J.P. exits soon. Zoom calls would be a weak substitute but predicting any future of 2021 is futile.

No theme was even attempted for the evening other than to end in the frustrated feeling around our views of the threat of COVID-19. Looking at the numbers daily, I can easily see (even in myself at that age) the college age attitudes of "get it and get it over with". As fall approaches our vigilance needs bolstering right at the time of weary fatigue.

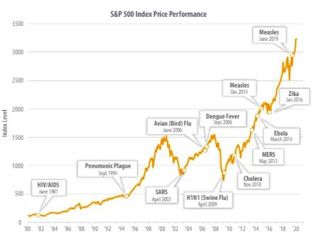

Today's news from United Kingdom predicting a fall growth in COVID-19 cases predates an October Halloween scare and created a market selloff. Will a similar second wave occur like the 1918 Spanish Flu? Even the hope of an early vaccine could be no different than the misguided belief that aspirin would control the Spanish Flu and may have contributed to deaths due to aspirin poisonings. The only sure thing we know is how much we don't know.

Weary not Worry is now my word for this crisis. Lament not Laugh is the emotion. What not Why is the thought exercise. Hope not Helpless is the attitude.